does doordash report income to irs

Your cash tips are not included in the information on the 1099-NEC you receive from Doordash. A form that is used to report income that is not subject to traditional withholding.

8 Essential Things You Should Know About Doordash 1099

Form 1099-NEC reports income you received directly from DoorDash ex.

. Since Drivers submit claims as self-employed DoorDash doesnt withhold any taxable income. Youll receive a 1099-NEC if youve earned at least 600 through dashing in the previous year. Yes DoorDash does report its dashers earnings to the IRS since it provides its drivers with 1099-NEC forms.

Answer 1 of 2. Incentive payments and driver referral payments. You should receive your income information from DoorDash.

This leads to a higher bill from the IRS. Yes - Cash and non-cash tips are both taxed by the IRS. Log into your checking account every pay day and put at least 25 of your dd earnings in savings.

This may come in the form of. Instead Dashers are paid in full for their work and must report their DoorDash pay to the IRS and pay taxes themselves when it comes time. Its provided to you and the IRS as well as some US states if you earn.

It will look something like this. A 1099-NECyoull receive this from DoorDash if you received at least 600 from DoorDash. Whether the payee vendor or contractor receives a 1099-K or not they are still required to report that income to the IRS and pay taxes accordingly.

A 1099-NECyoull receive this from DoorDash if you received at least. You do have the obligation to report any income to the IRS regardless of whether a 1099 was sent to you -- assuming you made at least 12550 total as a single taxpayer etc. As an independent contractor reporting self employment tax these are required.

If you didnât select a delivery method on your account DoorDash automatically mails and emails your. Per IRS guidelines Gross Volume processed via the TPSO which in DoorDashs case is the Subtotal and Tax on orders processed. If youre a Dasher youll need this form to file your taxes.

Yes DoorDash does report its dashers earnings to the IRS since it provides its drivers with 1099-NEC forms. Interest dividends alimony rent gains from the sale of assets prizes and awards. Dashers should make estimated tax payments each quarter.

Since youre an independent contractor instead of an employee DoorDash wont withhold any taxable income for you leading to a higher bill from the IRS. No because Dashers are not employees DoorDash does not withhold FICA taxes from their paycheck. Youre still required to report your rideshare and delivery income to the IRS even if you dont receive a 1099.

The most important box on this form that youll need to use is Box 7 Nonemployee Compensation. DoorDash does not take out withholding tax for you. Federal income taxes apply to Doordash tips unless their total amounts are below 20.

For 2020 if you make more than 600 in self-employment income you have to file a tax return. Consider sales tax in your area as well. DoorDash 1099s Each year tax season kicks off with tax forms that show all the important information from the previous year.

This sounds like a real drag but actually its a blessing in disguise. If Dashing is a small portion of your income you may be able to increase your income tax withholding at your day job instead of paying quarterly taxes. Theres also the issue of FICA taxes.

The payer must provide a completed form to the IRS and the recipient by January 31st of the following year. Internal Revenue Service IRS and if required state tax departments. They have no obligation to report your earnings of.

3 Continue this thread. This includes but is not limited to. FICA taxes for dashers FICA stands.

What is reported on the 1099-K. What you just said amounts to tax evasionwhether you receive a 1099 or not ALL income is required to be reported for the previous tax year. However you still need to report them.

There is also no withholding. Yes DoorDash does report its dashers earnings to the IRS since it provides its drivers with 1099-NEC forms. In 2020 the IRS has mandated that DoorDash report Dasher income on the new Form 1099-NEC rather than the Form 1099-MISC.

Typically you will receive your 1099 form before January 31 2022. Doordash will send you a 1099-NEC form to report income you made working with the company. Tax avoidance is every Americans patriotic duty.

Since dashers are treated as business owners and employees they have taxes payable whether they are full-time dashers or. -2 level 2 bigblard 1y Tax evasion is illegal. You can deduct expenses from that income such as mileage uniforms supplies part of your cell phone service and other overhead expenses you might incur.

However Doordash issues a 1099 form at the end of each tax year if you make more than 600 and reports your income as an independent contractor expense. If you wait until April to pay you could have to pay a penalty if you owe more than 1000. The forms are filed with the US.

Dashers are not required to report their income at the end of the year. Its provided to you and the IRS as well as some US states if you earn 600 or more in 2021. A 1099-NEC form summarizes Dashers earnings as independent contractors in the US.

To summarize a DoorDash driver pays roughly 153 of taxes.

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Common 1099 Problems And How To Fix Them Doordash Uber Eats Grubhub 2021 Entrecourier

How To File Your Taxes For Door Dash Drivers In 2022 Mileage Tracker Tax Deductions Tax

I Began Doing Doordash Last Year And Am Filing My Taxes In A Few Weeks I Saw On The Doordash Website Section About Taxes That Milage Info Would Be Sent Out On

Doordash 1099 Critical Doordash Tax Information And Write Offs Ridester Com

Is Doordash Worth It Earnings Tax Deductions And More The Compounding Dollar

15 Must Know Doordash Driver Tips 2022 Make More As A Dasher

Doordash Taxes 13 Faqs 1099 S And Income For Dashers

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

Is Your Insurance Covering You While You Deliver For Doordash Most Personal Policies Exclude Delivery Work Meaning They Won Doordash Car Insurance Insurance

Reporting Income On Taxes 2021 Doordash Uber Eats Grubhub Instacart

Doordash 1099 Critical Doordash Tax Information And Write Offs Ridester Com

Doordash Driver Canada Everything You Need To Know To Get Started

A Beginner S Guide To Filing Doordash Taxes 4 Steps

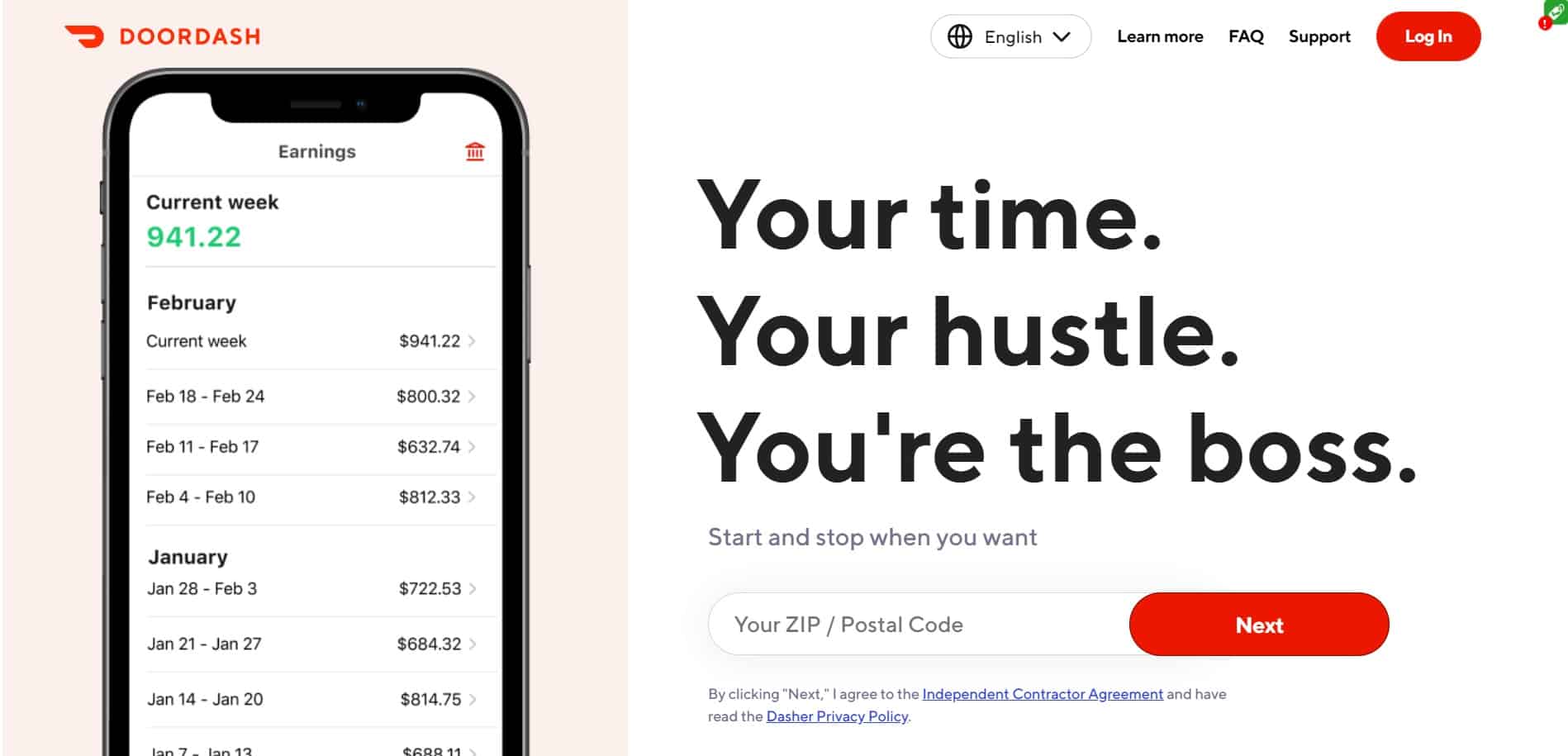

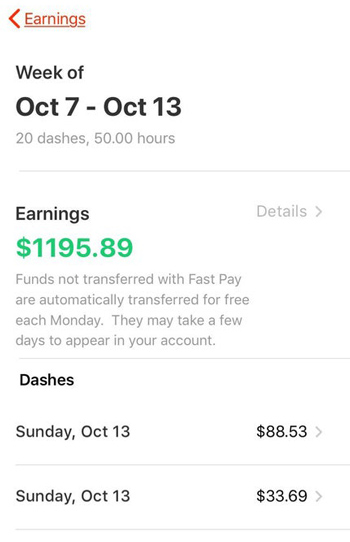

How Much Does Doordash Pay Dailyworkhorse Com

2022 Data How Much Doordash Drivers Actually Make Ridesharing Driver

How Does Doordash Do Taxes Taxestalk Net

Doordash 1099 Critical Doordash Tax Information And Write Offs Ridester Com

Reporting Income On Taxes 2021 Doordash Uber Eats Grubhub Instacart